Inculcate good money habits for children

Shruti Sharma -

Feb 08, 2022

Shruti Sharma -

Feb 08, 2022

As a parent, the best financial gift you can give your children is to teach them how to make smart money decisions. When you can help them understand the importance of saving for their future, and investing for the long-term benefits, then you’re giving them a gift that will last them the rest of their lives.

Set A Good Example

Children see what you do and not what you say, and children tend to develop the habits of their parents. Learn the basics of how money works. Then you can teach your kids. The ultimate responsibility for instilling good financial practices lies with parents. It'll be easier to help children understand the value of money if you show them how you are doing it effortlessly. The earlier you start the better it is. If your children help you with finances such as depositing cheques or paying bills, then they will begin to understand how important it is for them to manage their own money well. Help your kids figure out what they want to do with their money as well as help them allocate their savings.

Give Options, Not Everything

By playing game of choices, give them options of choosing amongst multiple things but also clarify that they cannot have it all. Help them understand why it's important to save money, spend wisely and avoid debt. Children can learn math while counting your change and figuring out their allowance. Saving teaches children discipline and responsibility. A good habit of saving is to set aside change in a jar or piggy bank every day. Over time, this will become a habit and it will also help with counting skills. If they earn money from chores (household tasks for 10-20 rs.), they should save half and spend half on something that interests them. Allow them to buy things like candy or toys if they want it.

Build A Budget

Build a budget with your child so they can see where the money goes and make it a family exercise. Kids find it fun and they also get to interact with parents on the topics, which otherwise are not talked about. Often parents don't discuss finances with their children and that is where the gap lies. While making budget, talk about your goals to inspire them to think about their goals. (click to set goals and invest) The bond you build between each other will last long after the lessons of finances are learned. Teaching them about having long term goals makes it easier to propel towards executing a plan. It also infuses habit to be disciplined about investing first and spending later. Slowly, allow the child to make small decisions, compare and choose products with sense of responsibility.

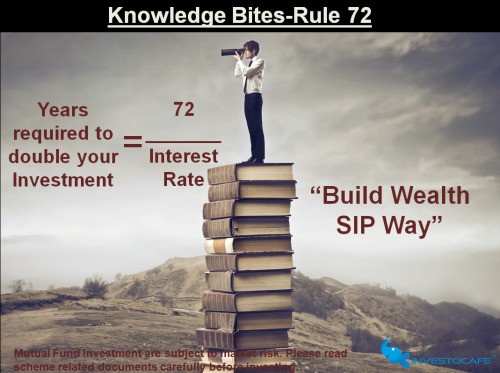

Younger investors have the advantage of time on their side. They’ve also got the better part of their adult lives to see the fruits of their investments. The trick is transferring that knowledge and patience to younger investors, so that they too could come out ahead in the long run. If you teach your children this valuable lesson early, it may only benefit them later in life.

Happy Investing!

Also read our blog, “Invest first, spend later” for more insights and mutual fund investing.

Know your risk profile at www.investocafe.com

See the difference of short term & long-term investing with our SIP calculator

Click to Start SIP NOW OR Contact Us @ 722-4051610

NOW OR Contact Us @ 722-4051610

Bring camera over code to call us & save our contact details

To see all our social media handles in one click, Scan following QR code

To get in touch please visit us at investocafe.com