Invest first, then spend without guilt

Shruti Sharma -

Jan 05, 2022

Shruti Sharma -

Jan 05, 2022

That’s Rs 180 per kg, said the fruit vendor. Things have become so expensive, Sunil said. But you love green apples papa, uttered his daughter. Reluctantly, he bought a kilo of green apple; with free storytelling about how prices were so low, when he was a kid. Also, it is not as if Rs 180 was a big amount for him, he could afford to buy even more. It is just that he did not have the heart to spend the money. So many of us needlessly fret when we have to spend. That act of spending makes people remorseful at times, an emotion most people are not comfortable with.

Apart from fretting over spending money and rising cost of living or inflation, we categorize money in our mind. Concept of mental accounting suggests that we place different values on the same amount of money, based on purpose of spending. For example, if you have accumulated Rs. 19 lacs in mutual funds, u can easily withdraw Rs. 4 lacs for your child's college fee but not for an international holiday, which you desired for years. Also, if you do not withdraw from accumulated wealth, spending and enjoying life becomes easier.

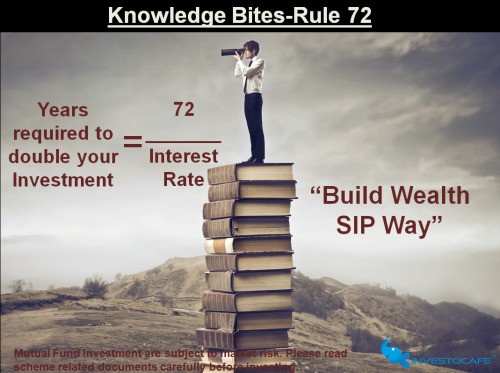

Guilt-free spending is an art, which is a by-product of goal-based investing. As you start investing in Mutual Funds, your financial planning and asset allocation improve. You not only deal with inflation better but achieve your desired goals successfully. At Investocafe, we help you achieve your goals effortlessly by estimating amount needed and by guiding appropriate funds to invest in for best possible return for that timeline. You are valuable and you should learn to love yourself and value your needs and comforts too by creating a balance between investing and spending.

To get in touch please visit us at investocafe.com