A Goal without a plan is just a wish

Team Investocafe -

Aug 27, 2018

Team Investocafe -

Aug 27, 2018

‘A Goal without a plan is just a wish.’

To reach our goals we have to have a full proof plan. The success path should be build in such a way that it leads to the final destination. How effectively we will build this path and how well the plans are made will ensure our success.Everyone dreams in their life; buying a Range Rover car, travelling to dream destination, buying a house, getting a degree from Harvard and many others.This list can be never ending but what is required to convert these dreams into achievable goals is the systematic planning, its execution and evaluation.

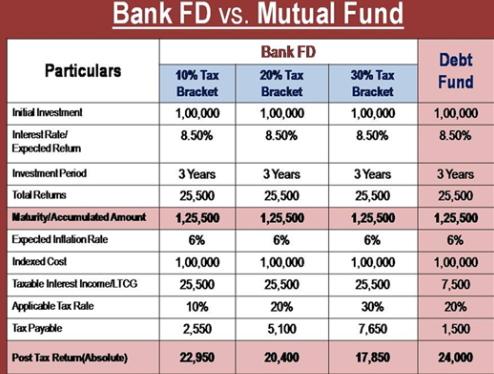

People invests in mutual funds to get pleasing returns, income generation, wealth creation, etc. This means investment is also made with a specific goal behind it. So, investment in mutual funds also calls for building a path that willsmoothly and safely help the investor to reach its final goal.

Now the question arises what is to be done? How do we build this path? On what basis the plans are to be made? The answer to all these questions is 'Risk Profiling’.

What is Risk Profiling?

In simple words, risk profiling is knowing how much risk you can take and also how much risk you should take. Risk profiling is the process of accessing the risk capacity i.e., the extent of risk you can afford to take, and the level of risk tolerance i.e., how you react to the situation when you actually face the risk.

The first step of investing money is to know, what kind of risk you can take and what kind of risk you should take. And this will help you define, how you can put your money in different investment products or asset class. Once you know your risk profile, you are able to determine, what kind of investor you are, what kind of returns you should expect from your investment portfolio,what kind of investment portfolio you should have.

The basic idea is to develop the best investment option based on the risk profile which suits investor and helps them to achieve their goal. It will be unpleasant to suffer a loss or miss an opportunity because you underestimated or overestimated the risk involved in the investment. Therefore, knowing your risk profile will help you in preparing a clear road map to meet future financial goals. It enables you to take right risk while investing and in tapping various investment opportunities that will suit your risk profile.

To do your risk profiling now go to the following link https://www.investocafe.comwhere you will find some simple risk profiling questions like : Your Age, No of dependents on you etc and know the asset class where you can invest which is suitable for your present financial health.

Written By: Charanjeet Laungia, Certified

NISM Mutual Fund Advisor, Intern at Investocafe

To get in touch please visit us at investocafe.com