Professor Sneha Bhatnagar: The Story of a Crore-Pati Woman

Tanish Goswami -

Jan 10, 2022

Tanish Goswami -

Jan 10, 2022

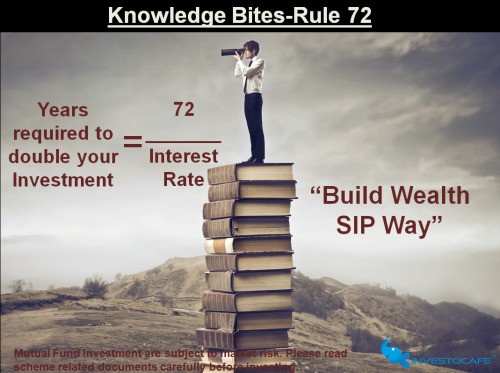

Investing in Mutual Funds is one of the best ways to save for your future. There are many challenges which Investor face due to lack of knowledge or time. With SIPs, you can invest regular monthly instalments over a period of time without worrying about market volatility or any other external factors that might affect your investment growth or returns, but still people refrain from investing because they find it risky and this is where the advisors of Investocafe come to the rescue.

Professor Sneha Bhatnagar, a 38-year-old mother of two from Bangalore, who decided to invest in mutual funds for the first time in 2015, has amassed a corpus of Rs. 1+ crore after investing an average of Rs. 80,000 per month through Systematic Investment Plans or SIPs for 5 years. This story will focus on Prof. Sneha’s investment journey and how it changed her life for the better. Prof. Sneha is one of the oldest clients of Investocafe and she started her investment journey in 2015 with Investocafe with an SIP amount of Rs. 10,000 for the purpose of tax saving. Her earnings were good and stable but she was finding it difficult to build wealth and do goal-based planning. She reached out to Investocafe advisor with a Goal to have 1 Cr. Rs in next 6-7 years for a particular desire, best known to her. Our advisor evaluated her other life situations, other investments, property and risk-taking ability and then increased her SIP amount to Rs. 80K per month and suggested suitable funds. She was also advised beat of investment behaviour and financial discipline. As and when markets were low advisor suggested her to park the lump sum capital in Liquids funds to start the Systematic Transfer Plan (STP) in her portfolio so that she can take dual advantage by not only earning returns from equity funds but to get good interest from liquid funds which increased the XIRR to 21%.

Investocafe’s advisor hand held her in this journey and as we entered in Year 2022, she crossed 1.3 Cr in her portfolio. We are ecstatic on this achievement and wish her best for coming years.

If you’re also new to the mutual fund investment and find it risky to invest in it, do reach out to us for expert advice and hand hold you through the entire process of investing. Just saving your money will not take you closer to your financial goals but multiplying it will surely. Investocafe will find you a suitable investment avenue matching to your risk appetite so that you can get maximum out from your hard-earned money.

Start SIP now Call our Executive - 0722-4051610 Read our blog

* With multiple cash flows, the Extended Internal Rate of Return (XIRR) approach is usually considered to be better than CAGR

About InvestoCafe

Investocafe offers customized financial solutions through their proprietary fully automated, paperless digital platform. Investocafe helps you in investing money in a systematic way for beat return possible. The company provides data-driven selection of mutual funds which are further customized as per the goals of the clients.

Investocafe have created a niche in a competitive financial industry by their strong ties with Mutual Fund companies and well-built customer association. The foundation of Investocafe is its core team, which has banking and finance industry veterans and entrepreneurs. Investocafe is one stop solution for all investment & financial advisory services with Bank grade security & zero-coat account management.

Team InvestoCafe is always accessible to share their best of experience and advise.

To get in touch please visit us at investocafe.com