What is stopping you to create wealth through Mutual Funds?

Manvi Jain -

Jan 19, 2022

Manvi Jain -

Jan 19, 2022

Mutual Funds fears can be a barrier to overcome, but I want to clear the air a bit: You don't have to be rich, or smart, or even lucky to beat everyone else in the game of investing. All you need is some common sense and a little patience to start building wealth through mutual funds.

Here are some key things which you should know-

1. Both Dividend and Growth option schemes of a Mutual Fund are same- MF is like a Pizza which you can cut either in 4 slices or 8 slices, but you will get the same quantity to eat. So, if a scheme is paying dividend your NAV will come down with that amount. Therefore, NAVs of dividend paying scheme are generally lower than growth scheme but the returns are similar.

2. NAV is just a number; focus on percentage returns - Many people invest in NFOs and Mutual Funds (MFs) having lower NAVs, thinking that lower NAVs will translate to higher returns. This is the biggest myth. Mutual Fund returns are always measured in percentages and therefore absolute numbers like NAVs do not matter. NAV is not like a stock price. It is just a number which facilitates allotment of units and calculation of returns.

For Example- Fund A having NAV of Rs. 10 is not cheaper than Fund B having NAV of Rs. 100. If they both give 20% returns, then the NAVs of both will be 12 and 120, that is it.

3. Yes, Mutual Funds also offer consistent risk-free returns- Many investors are not aware that there are different MFs schemes that invest in liquid and debt funds like government bonds. So, investors can expect a risk-free consistent return of 7–8% annually. Invest in Liquid Funds Now

4. Mutual Funds help in savings taxes- There are special MF schemes like Equity Linked Saving Schemes (ELSS) specially created with a lock-in for 3 years with which investors can saves taxes. All the investment in the ELSS schemes can be claimed as tax deduction under Section 80C. The biggest benefit of ELSS is that the lock-in is only 3 years compared to any other tax saving scheme and the returns are handsome. Start ELSS Now

5. Investment in Mutual Fund can be done in Direct and Regular mode both-There are many platforms online that allow you to invest in direct schemes of mutual funds but it becomes difficult to manage if you have invested in many funds. It is wise to use InvestoCafe’s paperless digital platform, where you can invest and redeem all funds at same place. You can manage your goals better too.

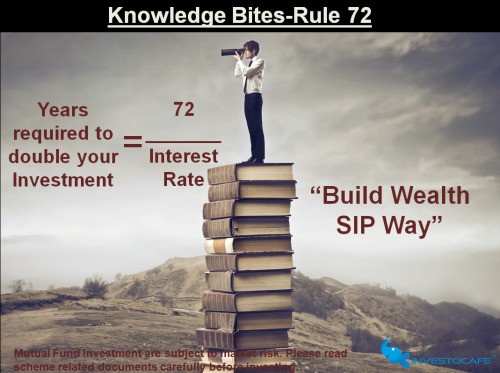

Mutual Funds are great to put your money to work for your future. The best part is you can use the power of compounding with Mutual Funds. So, if you have been thinking about investing but have been afraid, I hope this article can help assuage some of these fears.

Contact Us on - 0722-4051610

To get in touch please visit us at investocafe.com