Taxation on Mutual Funds for NRI

Tanish Goswami -

Jul 07, 2022

Tanish Goswami -

Jul 07, 2022

Mutual Fund Taxation for NRIs

Since last few years, Mutual funds are common choices for the investors in India as well as among foreign investors. They are becoming a popular choice because of variety of schemes available for customer to choose from and any initial investment amount to match the requirement. Another advantage of mutual fund is their flexibility and transparency, which usually attracts investors of all age around the globe. Some NRIs miss out on good returns due to lack of clarity related to investment and taxation liabilities. In this article, you will get to know about some important points that you should definitely know about.

Capital Gains Tax

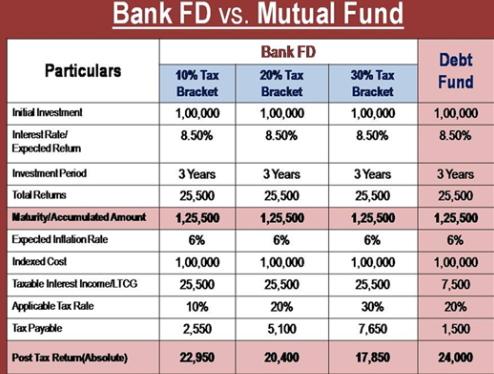

Your gains from mutual fund investment will be taxed like resident Indians Gains of above Rs. 1lakh from equity funds attract LTCG (Long-Term Capital Gain) tax at 10% without indexation benefit if the investment is redeemed after a year STCG (Short-Term Capital Gain) tax at 15% is applicable for redemption within 1 year.

LTCG tax is applicable at 20% with indexation benefit if the investment is redeemed after three years for debt and other types of funds. STCG tax at 30% is applicable if you belong to the highest income tax slab and redeem the investment before three years.

Double Taxation

India has DTAA (Double Taxation Avoidance Agreement) with more than 90 countries across the world. If you currently reside in a country with which India has a DTAA, you can protect yourself from double-taxation. In other words, if you’ve already paid taxes on your mutual fund investment in India, you will not be required to pay taxes on the same again or pay taxes at a lower rate in the country where you are currently residing.

Tax Deductions

Unlike resident investors, mutual fund investments made by NRIs are subject to TDS deductions in India. If you have invested in equity funds, TDS will be deducted from your LTCG at 10%. The same for debt and other non-equity funds is 20%

Note that TDS is deducted, assuming that you belong to the highest income tax bracket. In case if your tax liabilities are lower, you can claim a tax refund by filing yearly returns.

Setting-Off Gains with Capital Losses

Another vital aspect of NRI mutual fund taxation is setting-off capital gains with losses. NRIs are allowed to set off their capital gains made in a financial year with the losses made in the year. For instance, you can use gains from equity funds for setting off losses from debt funds and vice-versa.

However, you can only set off long-term losses with LTCG. STCG and LTCG can be used for setting-off short-term losses. Note that TDS is deducted, assuming that you belong to the highest income tax bracket. In case if your tax liabilities are lower, you can claim a tax refund by filling yearly returns.

Bottom Line:

Like any other investment, it becomes very important to focus on taxation aspect in mutual fund before starting investing. As some rules are different for NRI, one should ensure that they understand it thoroughly to get maximum benefits out of their investment. You can also consult with a wealth manager at Investocafe for initiating your hassle-free, paper-less digital investment after understanding all the rules and regulations.

To get in touch please visit us at investocafe.com