ASSET ALLOCATION - SIMPLE TOOL TO WEATHER MARKET STORM.

Amit Meena -

Sep 17, 2021

Amit Meena -

Sep 17, 2021

Dear Investor,

Season Greetings!!!

Past 15 months were extremely challenging for us as a country to tackle the pandemic. Some of us have lost the near dear ones. At the same time Challenging times threw some other opportunities in terms of firing animal spirits in economy and a vibrant stock markets. Markets have delivered ~140% positive returns from their lows of 7500 levels.

Few common questions which has, been now asked frequently in the investing circle due to the sudden raise in markets are:

1. Is there a probability of big fall coming in markets again, since they have risen too much in very short span of time.

2. Should one be booking entire profits from market and come back to safety.

3. Since markets are out performing should one be committing all their savings to markets to make higher return, if markets have to go more up.

The solution to all these burning questions is one and that is appropriate ASSET ALLOCATION.

Now one may ask how to ascertain what should be an appropriate asset allocation model for individuals to follow, which they can implement as a do it yourself model. The simple answer is AGE RATIO Model.

An iteration to understand this model is below.

A investor should be keeping an amount in debt equal to his age and balance in equity. so if an investor is aged 30 years, he should be subtracting 30 from 100, i.e; 30% of his/her assets should be in debt and 70% in equity. Similarly some one who is aged 60 years, should be keeping 60% of his/her assets in debt and balance 40% in equity oriented instruments.

This model automatically ensures lower risk for elderly people as compare to younger ones who can afford to take higher risk for making superior returns. If you don't have an advisor you can simply follow this principle to reshuffle you portfolio atleast once a year. In current times too when markets have grown disproportionately, this exercise will help investors protect the gains as it will force them to come towards debt.

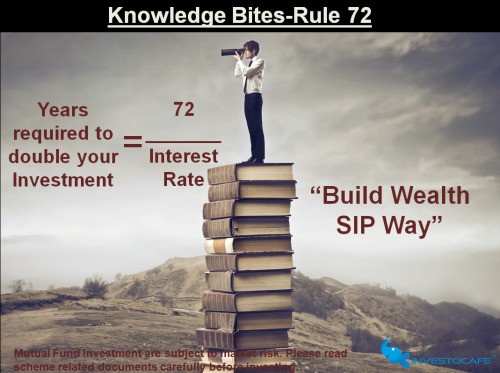

Also, anybody who is following a SIP model of investing needs to keep time frame of 5-7 years to create meaningful wealth from equity funds.

Moreover, for getting your portfolio managed more smartly you can open a free investment account on investocafe and get in touch with professionally qualified portfolio managers from Investocafe for timely asset allocation support.

Existing investors can book an appointment to understand the current market scenario and the asset allocation strategy which investocafe is advocating in current challenging times.

Stay Healthy and Wealthy!!!

For Investment contact Us

Tanish Goswami - 9131339140

Supervisor

Rahul Gehlot – 9826625009

Website – http://www.investocafe.com

To get in touch please visit us at investocafe.com