5 Financial Mistakes while Investing for Children

Shruti Sharma -

Mar 16, 2022

Shruti Sharma -

Mar 16, 2022

Saving for children is a noble idea as your children are your future and this generation will shape the world tomorrow. So, it is important to save for your child's future, but how do you do it? And what mistakes do new investors make in this regard? This article takes you through 5 financial mistakes while investing for children.

Being rigid about education streams

“While there is nothing wrong with being focused on traditional streams of education, parents need to remember that not all kids have the same ambitions, aptitude or talent”, says Anvesh Pandey, CEO-Investocafe & Registered Financial Advisor. Parents may invest for education goal they like, and child may end up preferring something else. Rather than traditional streams, child may want to play sport, or have a music career or wildlife photography like in Farhaan in ‘3 Idiots’. The money required for professional training may be required at earlier stages, rather than at 18 years something, in case of traditional streams like medicine & engineering.

Not considering education inflation

Education inflation is higher than consumer price index (CPI) inflation. While CPI is at approximately 6%, education inflation ranges between 10-12%; which means you might need even higher goal value than you initially thought. Now as you know correct inflation rate, use best calculators available here to calculate goal amount Click to calculate

Wrong calculations in terms of detailing

If you adjusted goal as per above point, you would want to re-look into detailing of education. For example; college fee you did consider but forgot to consider hostel expenses. For education abroad, you missed Visa fee consideration or consultant fee, or didn’t add travel expenses or were too dependent on scholarship expectations. These all mistakes might lead to fund shortages. Further, for some courses coaching is also expensive.

Choosing wrong investment avenues

Choosing Insurance plans for long term investing may prove costly. You not only need to beat inflation but grow money too; and so, instruments like equity or mutual funds are best option. Also, taking help of financial advisor for proper asset allocation is always encouraged.

Not starting early

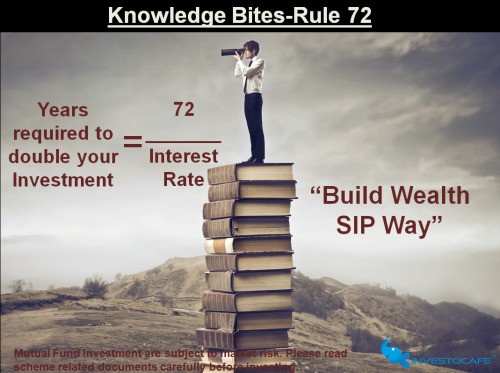

It is a very common error to think that there is a lot of time. Do not wait till your child starts school or college to start the plan because there will not be sufficient time. The earlier you start investing for them and the longer the money remains invested, the greater is the return on your investment. The power of compounding is at its best when time is on your side.

Watch this short video with real data & calculations to understand power of compounding well https://www.youtube.com/watch?v=nJWin6PQ9T0

The bottom line is that you need to start investing for your child’s future as soon as possible. While investing for your child’s future is important, it may be even more important to start moving away from the “one size fits all approach.” No matter what option you choose, ensure that you do your due diligence, and select the investment that best fits your goals. Go ahead and make that money work for your child.

Start SIP NOW Know your risk profile at https://investocafe.com/

Contact Us @ 7224051610 or write at info@investocafe.com

To get in touch please visit us at investocafe.com