How Inflation Eats into Your Returns?

Shruti Sharma -

May 13, 2022

Shruti Sharma -

May 13, 2022

Inflation is showing up as a result of all the free money issued by central banks around the world to counteract the COVID-19 slowdown & Russia-Ukraine conflict added spice to it. Inflation lowers one's purchasing power, or ability to buy goods and services. The expense of living rises as inflation rises, but the return on investment does not. In March 2022, retail inflation in India reached 6.95 percent, the highest level since October 2020 and increased to 7.79% in April of 2022, the highest since May of 2014.

Materials, labour, and capital costs are all increasing for businesses. Companies are often unable to pass on increasing expenses to customers. Corporate margins are constricted as a result, and stock prices are dragged down by predictions of weaker future cash flows.

Course of Action

Should you restructure your investment portfolio for an inflationary climate, allocating some of your money to sectors or asset classes that do better during periods of inflation? Should you leave your investments alone and let the markets decide what happens to them in the long run? The answer is contingent on how long you anticipate inflation to endure and if we are already experiencing rising inflation. Deposits and debt funds cannot cope with high inflation and end up eroding your savings. The solution lies elsewhere.

What Does It Mean to "Beat Inflation"?

To beat inflation, one must make larger returns on investment than the rate of inflation in the economy. Your returns are null and worthless if the increase in the price of goods and services exceeds the returns you earn on your assets.

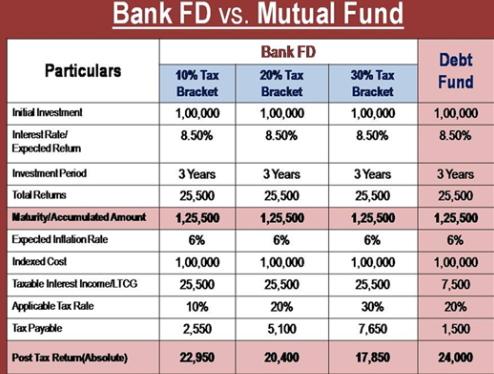

While we may believe we have received remarkable returns, most investments, such as fixed income and gold, rarely generate wealth when adjusted for inflation. The difference between nominal returns (for example interest rate on FD) and inflation is called real return. If you have Fixed deposit with 6% nominal return, after adjusting inflation now; your money practically is losing value with the rate of 1% per year.

One of the best strategies to combat inflation is to invest in products that have a higher possibility of being equal to or greater than the rate of inflation tomorrow. When choosing the best investment products to fight inflation, investors should always undertake thorough research on their risk profile and goals.

Assessing your risk profile and financial objectives may become complex. Getting financial guidance from a wealth manager can help you determine your risk tolerance and define financial goals. Investocafe provides personalized portfolio review to help you achieve your financial goals.

Equity Mutual Funds to the Rescue

Many investors find it difficult to keep track of specific equities or the market on a daily basis. After choosing which fund looks to be most suited to their unique needs and objectives, they can invest in equities mutual funds. Different types of equity funds exist to fulfil the needs of different types of investors. Equity funds based on market size, sectoral funds, equity funds based on investing methods, tax-saving funds, and more are available. The 5- and 10-year returns of most stock funds have consistently maintained around 13-15%. Use SIP returns calculator

Bottom-line

Inflation is the most significant threat to investment profits. Real returns (returns minus inflation) must be positive rather than being zero or negative. In the long run, equity has one of the best chances of beating inflation. Because of the risk of capital loss, investors are moving away from stock. It is vital to be farsighted rather than nearsighted. Over the time, the volatility of equities returns reduces significantly.

Education inflation is higher, read this blog to know more

https://investocafe.com/blogs/blog_detail/5-mistakes-while-investing-for-children

Start investing Now! Book FREE Portfolio Review session & seek professional help.

Contact Us @ 7224051610 or write at info@investocafe.com

Know your risk profile at https://investocafe.com/

*Return are indicative

To get in touch please visit us at investocafe.com