Plug These Money Leakages for Fuller Bucket of Wealth

Shruti Sharma -

Feb 23, 2022

Shruti Sharma -

Feb 23, 2022

Money can disappear faster than water from a busted pipe. It's vital that you plug these monetary leakages to ensure that your wealth stays intact. While it's important to look at the budgeting, debt management etc -- there are certain money leakages that can add up and make quite a dent in your finances over time.

Here are 5 points you need to be paying attention to:

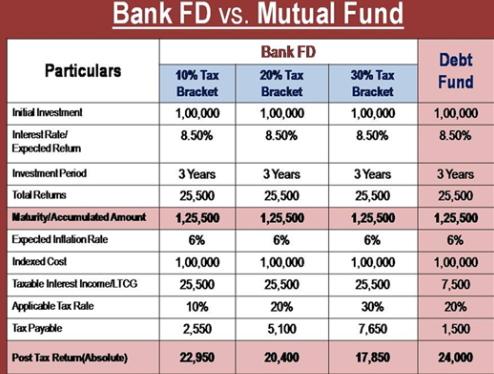

1. Inefficient Tax Planning

Higher tax outgo is very common due to investment in inefficient investment products like fixed deposits and bonds. Not only their returns are low, but their post-tax returns are even lower. For example, a three-year FD of 5.4% interest rate gives post tac returns of 4.32% only. If you adjust it against 6% inflation, you are actually having negative returns; that means, in simplest terms, your rs 100 are now rs 98.30only. Also, in case of Mutual Fund, growth option is better as your money is reinvested. By taking dividend, not only investment is reduced but they are taxed too.

2. Wrong Insurance Policies

One of the biggest reasons for the wealth leakage is that you are paying premiums for wrong insurance plans. The primary job of insurance is risk mitigation - it gives you peace of mind by ensuring that your family is protected financially against any unforeseen circumstances, it is not an investment product.

3. Take Advantage of Tax Provisions

Couples can minimise total tax liability by separating their investment and gains. Clubbing of income provision can be sided if money is gifted to spouse for investment in tax-exempted products like PPF.

4. Harvest Tax Losses

Without asset-class restriction; long term capital gains can be set-off against both long & short-term losses. You can also carry forward such losses for up to 8 years, if you have nothing to set-off in current year. Also, you must file returns.

5. High Balances in Savings Account

Don't let your cash sit idle in a savings account when it could be earning more interest elsewhere If your rs 20 lac are sitting idle at 4% interest & you are getting 7% elsewhere; you would lose rs 60,000 in a year.

It is important to take action & it is always suggested to take help of advisor. Plug these holes to enhance your wealth. Remember that each and every rupee you spend, invest or save will earn an incremental or complete return over the longer period of time. After all, the secret to a richer life is not how much you earn, but how much you keep.

Know your risk profile at www.investocafe.com

See the difference of short term & long-term investing with our SIP calculator

Start SIP NOW

Contact Us @ 722-4051610

To get in touch please visit us at investocafe.com