How NAV affects the Mutual Funds?

Tanish Goswami -

May 04, 2023

Tanish Goswami -

May 04, 2023

When it comes to mutual funds, there are a lot of options for every kind of investor. Regardless of their risk tolerance, investors can easily find mutual fund options that meet their requirements. When there are so many options available, how can investors select the most suitable fund for their needs?

One of the best ways to predict a fund's viability or profitability is often its past performance. Good-quality underlying assets that are able to endure market trends will be found in a fund that has consistently performed well and offered respectable returns during market highs and lows. Additionally, a fund of this kind demonstrates the fund manager's capacity to steer the portfolio through market volatility and accomplish the investor's ultimate goal of wealth growth. The fund house, the market, their investment strategy, are additional hints that the fund's previous performance has been stable.

While many investors only take into account a mutual fund's past performance, the fund's net asset value (NAV) is just as important.

What is mutual fund NAV?

Financial backers often don't have the foggiest idea how to assess a shared asset's exhibition while making an interest in one. It is impossible to evaluate the performance of mutual funds using just one asset because mutual funds are comprised of multiple securities rather than just one.

When matched with different contemplation like past execution, risk factors, AUM (Resource Under Administration), and so on. Investors can learn more about mutual funds by understanding the concept of net asset value.

The market esteem per unit of a shared asset is addressed by its net resource esteem (NAV). The price at which investors buy fund units from a fund house (the "bid price") and sell them to a fund house (the "redemption price") is known as this.

Today, mutual funds can hold a variety of bonds and stocks, and the value of those investments can change daily. As a result, mutual fund NAVs fluctuate daily, just like stock prices.

However, there is a significant difference between the NAV of mutual funds and stock market shares. When the markets are still open, the net asset value (NAV) of a mutual fund scheme is determined close to the end of each day. Subsequently, the NAV just changes once consistently.

However, when shares are traded during market hours, the price of equity shares changes immediately.

How can the NAV of a mutual fund be calculated?

The recipe for computing the NAV of common assets is as per the following:

NAV = (Complete Resources - All out Liabilities)/All out number of remarkable units

Or on the other hand

NAV = (Net Resources of a Shared Asset)/All out number of extraordinary units

The amount of the relative multitude of units given by the common asset to its financial backers is all the all-out number of extraordinary units, which is utilized in the recipe above to work out NAV.

Since the NAV formula takes into account a mutual fund's total assets and liabilities at the end of each day, the value of the fund's net assets only changes once per day.

How pertinent is NAV to investors?

When a fund's NAV is low, investors who attempt to time the market typically want to invest in one lump sum and redeem when the fund's NAV rises. It is anticipated that the difference between the selling NAV and the purchase NAV will maximize the investment's profit.

Due to the unpredictability of market fluctuations and changes in mutual fund NAV, this is theoretically possible but extremely challenging to implement.

Instead of only paying attention to a mutual fund's NAV and attempting to time the market, investors should concentrate on being methodical with their investments and remaining involved over the long term.

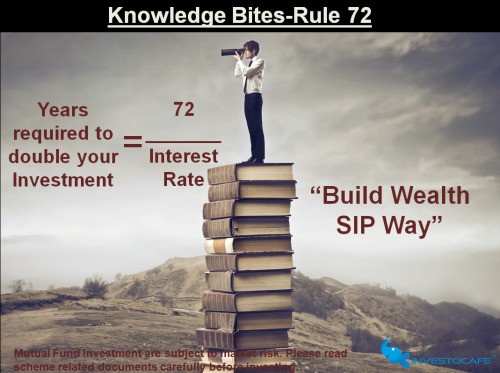

By investing regularly and methodically, such as through a systematic investment plan (SIP), investors can take advantage of rupee cost averaging, which reduces the overall impact of NAV fluctuations.

Additionally, investments in long-term mutual funds, particularly equity-oriented ones, will have more time to grow. The investor will then be able to use the power of compounding to its fullest extent.

Which is superior, a lower or a higher NAV?

The fund's fundamental value is the only thing the NAV represents. Investors, according to financial experts, are unconcerned about the higher or lower NAV.

Take into consideration what would happen if you were to invest in two plans with identical portfolios. Because it has been around for some time, one scheme has a higher NAV.

Because it is more recent, the other scheme has a lower NAV. The financial backer would get a more prominent number of units in the plan with a lower NAV and fewer units in the plan with a higher NAV thus.

However, none of them would see a difference in returns as a result of the scheme's investment appreciation or depreciation because their portfolios are identical.

The Reality

The common asset's portion cost per share is known as the NAV. It will not fluctuate throughout the day, unlike a stock price; instead, it refreshes after each trading day has ended. On the other hand, a stock's price fluctuates frequently.

Mutual funds are similar to a basket containing numerous shares from a variety of businesses. Therefore, a mutual fund's Net Asset Value (NAV) plays a crucial role in performance evaluation.

Because mutual fund net asset values fluctuate once per day, investors should focus on being meticulous with their investments and remaining active over the long term.

So presently, when we understand what NAV is and its significance for common assets, we as a whole can accept when that's what we say "Mutual Funds sahi hai!"

Book one complimentary wealth management consultation with Investocafe’s certified advisor.

Happy Investing !!!

Visit www.investocafe.com to know about mutual fund investment options and stay on path of financial freedom

Written by: Tanish Goswami

To get in touch, write to tanish.goswami@investocafe.com or reach through www.investocafe.com.

To get in touch please visit us at investocafe.com