How Asset Allocation Beats Deceptive Statistics Figures in Wealth Creation

Pradeep Singh -

Mar 31, 2020

Pradeep Singh -

Mar 31, 2020

WHY ASSET ALLOCATION

When any investor decides to invest his/her hard-earned money in any financial instrument available in the market .It is quite obvious, investors go through lot of statistical data points about the financial instrument, that how it performed in recent past ( We shall be writing on recency bias also that makes investors commit mistake). Given its ability in past performance guides majority on investors decision making rather following a meticulous asset allocation mix.

The problem is that these sorts of predication aren't very useful in case of unforeseen circumstances, which are very common in today's world not precise to tell you whether investor should invest or not. So let alone making decisions basis past performance is not the right thing.

Investocafe has been after something else. instead of statistical model, we focused on a living and breathing model, the one that simulated the actual physical process that in ideal scenario govern our investors investment and guiding philosophy to the investors

As certain time our ability to compute the fund performance has long lagged behind our theoretical understanding of it, however. We know which equation to solve and roughly what the right answer are, but we just aren't fast enough to calculate them for every investor of investocafe. Instead we have to make some approximation.

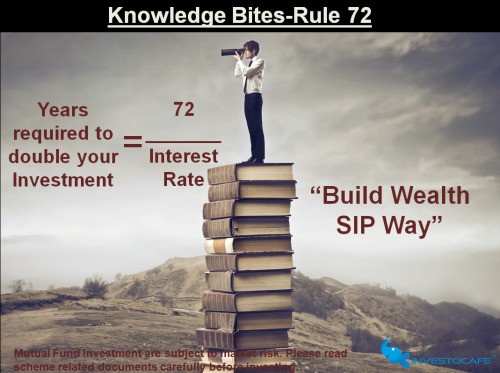

The most intuitive to do this is to simplify the investment method by breaking the total investment into a finite number of funds basis risk profile of customer, his investment horizon and objectives and create an equity debt mix, What we normally refer to as asset allocation , a matrix or a grid. Primarily it saves an investor in over committing towards one asset class.

HOW ASSET ALLOCATION WORKS

One of the most important aspect of asset allocation is ability to predict and provide a direction to investors portfolio according to his requirement. I would argue that it is the single most one is called calibration.

Calibration is difficult to achieve in some of the financial instruments like equity mutual fund and stocks . It requires to think probabilistically, something that most us requires to analyse carefully . It really tend to punish overconfidence - a trait that most of us have in while doing investment. It also requires a lot a lot of data, to evaluate cases where Financial advisor have issued lot of prediction with precision.

Investocafe meet this standard with the help of asset allocation for their investors. In asset allocation method the investment are done according to individual investor financial goal.The risk are diversified among various financial instruments.

Let's take a example of mutual fund investment, in mutual fund we have three categories equity, debt and hybrid fund. You can create a number assumption based on the status of each category risk.

The safest of these category is debt fund, what i call suitable for conservative investor with least risk taking ability.Hybrid fund comes with medium risk , as its the amalgamation of equity and debt fund. The third category is equity mutual fund . which is suitable for the investor who has ability to take risk and want to remain invested for longer duration as fund will see lot market fluctuation.

Why might an investor prefer making a bet on the equity mutual fund to the debt fund ?

That's easy - because it will be priced more cheaply to account for the greater risk. But say you are risk averse investor, what suit such investor most is a fixed deposit and that prohibits investor from investing in highly volatile equity fund. At investocafe you are offered anything that will be debt or hybrid fund , which assuredly be high rated financial instruments.

So one assumption is that each category of fund is independent of each others. We are investing in all three category simultaneously, so investors risk is well diversified. If an equity fund does not perform this will have no bearing on whether a debt give return or not. Under this scenario the loosing your bet would be exceptionally small.

The other extreme is to assume that instead of investing in a multiple category invested in single category. Here you are now staking bet on the outcome of just one.

Which of these assumption is more valid will depend on economic conditions. If the economy and market governing factor are healthy , the second scenario might be reasonable approximation. Since we know utopian condition don't exist and default are going to happen from time to time because of unforeseen circumstances.

In broader sense, to minimize risk and uncertainty. It would be always advisable to follow asset allocation methodology.

The investocafe investment Robo-advising services are turning out , admirably well calibrated. As we have investor of all age bracket from minor to 70 year old. We follow age based asset allocation and according to financial goal of individual investor. few examples are for mentioned below for better understanding

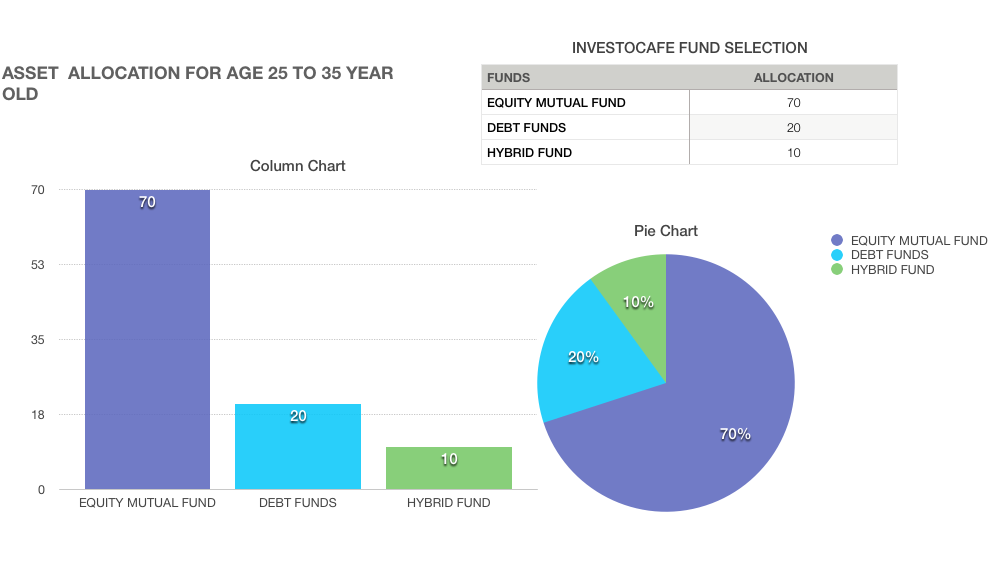

Age Based Asset Allocation for an Investor of Age 20 to 35 year old

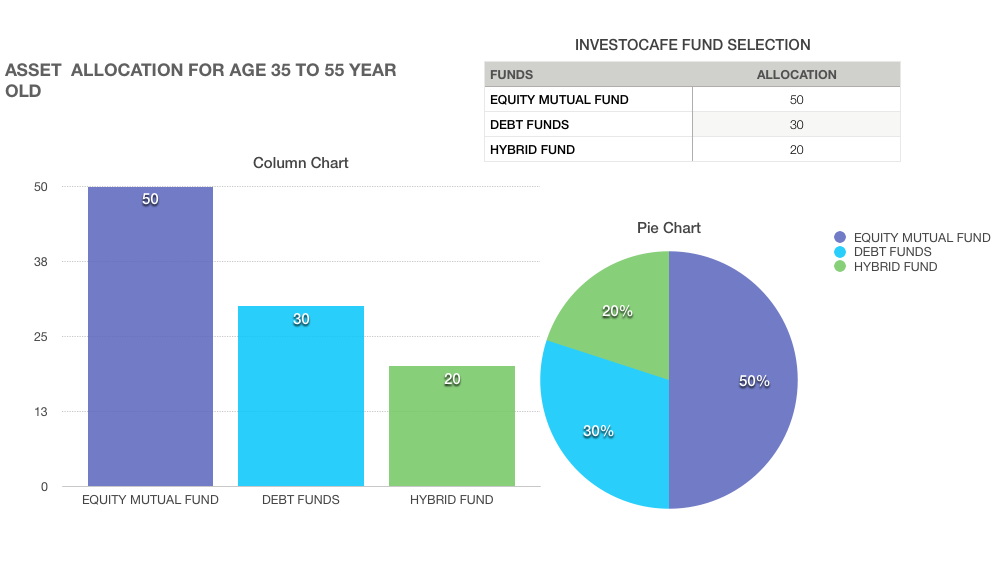

Asset Allocation For Age 35 - 54 year Old

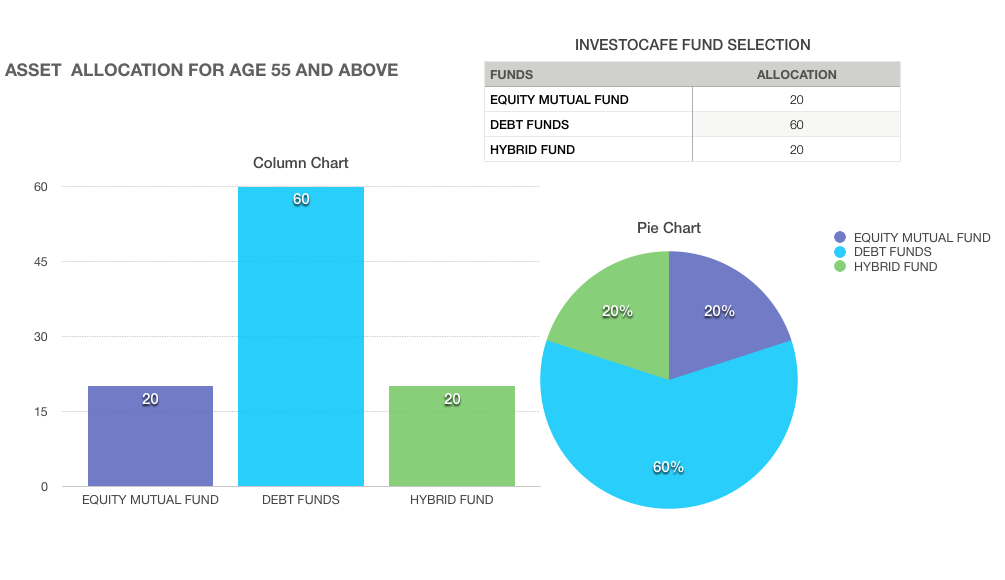

Asset Allocation For Age 55 & Above

In current uncertain times of corona virus calamity, markets have taken a hit by negative 40%, stocks have even fallen by 70-80%, whereas well calibrated approach at investocafe has kept investors afloat. If you need any support in this regard or would like to understand and discuss more about your portfolio feel free to write back.

Pradeep Singh

Wealth Manager

To get in touch please visit us at investocafe.com