Extending NPS Beyond 60?? Yes or NO.

Shruti Sharma -

Jul 22, 2022

Shruti Sharma -

Jul 22, 2022

According to recent statistics, 83% of NPS subscribers over the age of 60 decide to keep investing when they reach maturity. Subscribers are extending the accumulation period well into retirement as opposed to choosing to accept the pension and remove a portion of the NPS corpus. Subscribers can currently invest in the pension vehicle up until the age of 75. Is this an effective retirement plan? What can subscribers anticipate during this stage?

Current Regulations & Taxes

Currently, regulations allow NPS subscribers to withdraw up to 60% of the whole corpus at maturity. For a regular pension, at least 40% of the corpus must be invested in an annuity product. 80% subscribers, nevertheless, opt to postpone the vesting age. Experts say that delaying annuities now makes sense. The pension from annuity component would be quite modest at the low interest rates in effect right now. Over the next few years, as interest rates rise, an increase in annuity rates is anticipated.

Subscribers who continue investing in NPS after turning 60 can cancel at any time before turning 75. Additionally, the distinct tax advantages provided by the NPS provide a powerful incentive for ongoing donations. Over and above the Rs 1.5 lakh window of Section 80C, NPS subscribers can continue to claim an extra tax deduction for investments up to Rs 50,000. The NPS tax benefit under Section 80 CCD(1B) alone can save 15,600 Rs. in taxes in a year.

Does it Make Sense?

Letting the NPS pot develop makes sense if you won't want an immediate payout when you retire. Particularly if you continue to get substantial income after retirement—whether it comes from a pension or any other source, such as part-time employment or housing rent—continuing with NPS makes more sense. This can be used to raise the corpus for later retirement years in the NPS. However, new subscribers ought to have realistic expectations and a positive attitude.

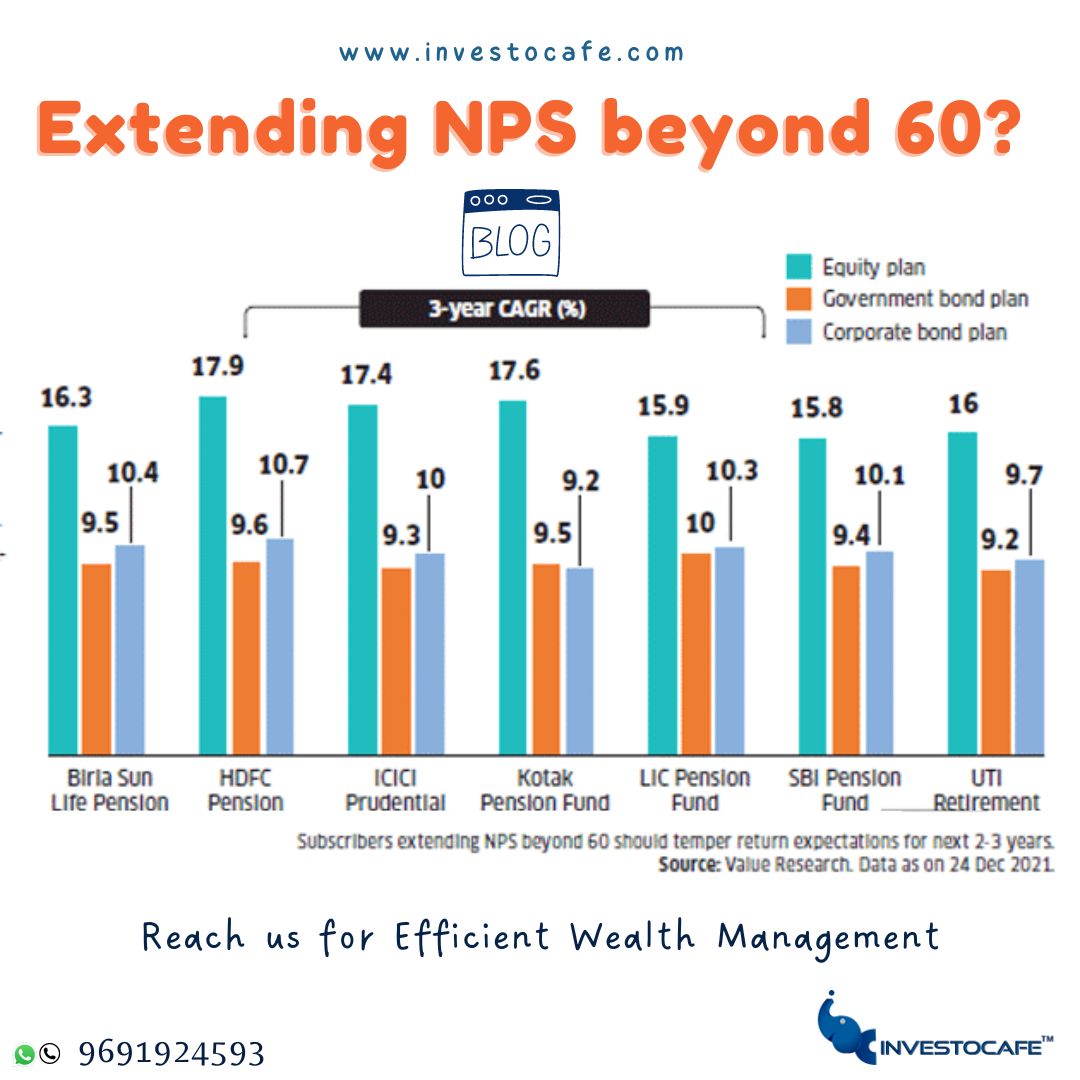

Be ready to continue NPS contributions for at least 5-7 years given the current state of the equity and bond markets. Over the previous three years, NPS equity plans have generated an annualized return of 16.7 percent. However, equities gains are likely to remain modest and be accompanied by considerable volatility in the near-to-midterm. Therefore, do not anticipate your NPS pot to increase on the strength of its equity investments in the following two to three years. The NPS bond market is also anticipated to offer modest yields. On account of declining bond yields, the NPS corporate and government bond plans have generated annualized returns of 10% and 9.5%, respectively, over the past three years. However, in the foreseeable future it is anticipated that interest rates and yields would increase.

Additionally, it's critical to balance your NPS assets appropriately given your age and risk profile. Even in retirement years, Investocafe advises maintaining some equity exposure. Your money will be quickly depleted by inflation if the portfolio isn't driven by equities. However, given their limited time, retirees cannot afford to take unnecessary risks. NPS permits users over 60 to allocate up to 50% of their portfolio to stocks under the Active option. NPS subscribers might restrict allocation to this category if they already have a sufficient amount of equity exposure through equity funds. Otherwise, maintain healthy NPS exposure to this portion. Investocafe advises retirees to have up to a 30–40% equity investment during this era.

Bottom-line

Equity funds, according to experts, are the finest choice for facilitating cash flow in a tax-friendly way. Compared to NPS annuities, SWP (Systematic Withdrawl Plan) from equities funds would produce tax-efficient cash flow. Reach Investocafe for smooth wealth management. While NPS pensions would be taxed at the applicable slab rate, any withdrawals from equities funds that result in capital gains over Rs 1 lakh in a year (No tax till 1 lakh) will be taxed at a rate of 10%. While the NPS is tax-friendly during the accumulation period, it is not when taking pension payments; observes Anvesh Pandey, CEO-Investocafe. Senior Citizens Savings Scheme and Pradhan Mantri Vaya Vandana Yojana restrictions for fixed income should also be fully utilized by retirees in the interim.

Calculate Investment Returns here!

Book one free wealth management consultation with Investocafe’s certified advisor.

Contact Us @ 7224051610 or write at info@investocafe.com

To get in touch please visit us at investocafe.com